It may stun some folks, but successful investing often relies more on managing emotions than on managing the market. I’m emphasizing this even after analyzing fund and macroeconomic data for the last three hours. Our biases and emotions play a strong role in our investment decision-making, often to our detriment.

Let’s start with recency bias, also known as, “markets are falling and they will continue to fall because they just fell.” It also happens to be my girlfriend’s bias toward my cooking. Just because I burned spaghetti 10 times in the past doesn’t mean I will burn spaghetti 10 times in the future. (Okay, I might.) However, it does apply to investing and the markets. This is also called zoom theory. It’s the tendency to overweigh recent experiences when forming a view of the future. It’s why folks think they can tolerate risk when returns are strong, only to sell when asset prices fall. They zoom in. Let’s zoom in on the most recent sell off for an example:

Uff-da, a 15 percent decline, that’s a pretty bad deal. What happens when we zoom out over the past 10 years?

If you look hard enough, you can see it. It’s that little red box in the corner. It’s why long-term investors are rewarded. Now, I’m not advocating an investor place all of their assets in the U.S. equity market. It’s still absolutely important to have a well-diversified portfolio and own some bonds or fixed income. What I am saying is that it’s important to take a long-term perspective. It’s okay to tune out the talking heads on Joe Schmo’s Financial News Network.

The next bias we’re going to discuss is herding bias. It reminds me of when I was a kid and I’d complain that someone else did something that I wasn’t able to and my mother would respond with, “if so and so jumped off a bridge, would you?” Herding bias is the tendency to follow the actions of a large group, whether those actions are rational or irrational. It’s rooted in early human behavior. It plays into investor behavior by rationalizing certain buying and selling dynamics. For example: everyone is buying stocks, so I should buy stocks OR, alternatively, everyone is selling stocks, so I should sell stocks.

Myopic loss aversion. What did you just call me? The nerve of some people. Actually myopic loss aversion is a common bias that’s represented by the frequent evaluation of a portfolio’s performance. This can lead to shifts in an investor’s long-term asset allocation mix. Investors who review their portfolios more frequently have tended to shift toward more conservative portfolios, as increased monitoring raises the likelihood of seeing and reacting to a loss, oftentimes to an investor’s detriment.

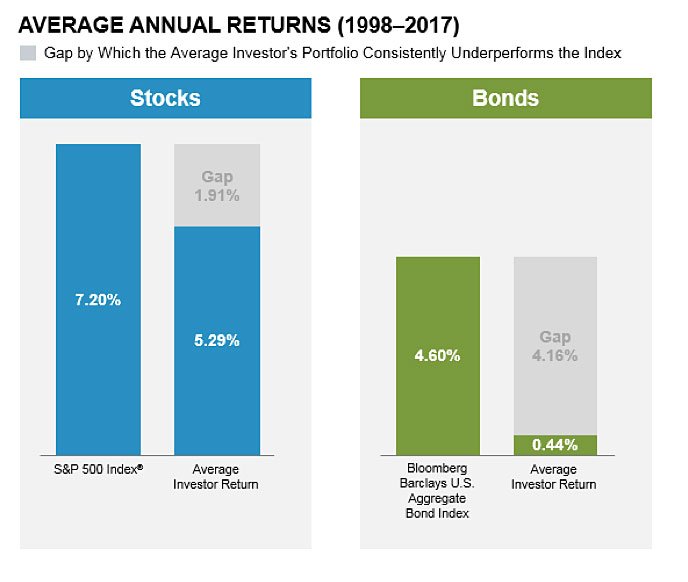

All of these behaviors in this article can prompt mistakes in market timing. It’s why average investor returns are generally lower than the market:

So how can we, as investors, guard against our worst instincts and avoid these mistakes? It starts with having a portfolio that’s aligned with your goals and risk tolerance. Even the most seasoned investors can be unnerved during a market decline. Here are four steps all of us can take to mitigate this behavior:

- Get to know yourself.

- I’m not saying you need to find inner peace, but be aware of how your tendencies affect financial decisions.

- Avoid panic selling.

- Stay invested during times of market volatility. Better yet, anticipate market volatility and know that you’re comfortable with your portfolio beforehand.

- Stay focused.

- Don’t dwell on the past; focus on your long-term goals and time horizon.

- Consult with your advisor regularly.

- Having an objective third party can help take the emotion out of investing.

Do you feel like you’re properly invested for your risk tolerance? Call us at 701.235.2002. We’re more than happy to discuss it with you.