Since target-date funds were first offered in the early 1990s, they’ve become a widespread investment vehicle for retirement. Their booming popularity is no surprise. After all, a target-date fund (or TDF) is easy for novice investors to manage, and even experienced investors can appreciate the hands-off simplicity they can offer.

But do your research: a TDF may not always be the best choice for you.

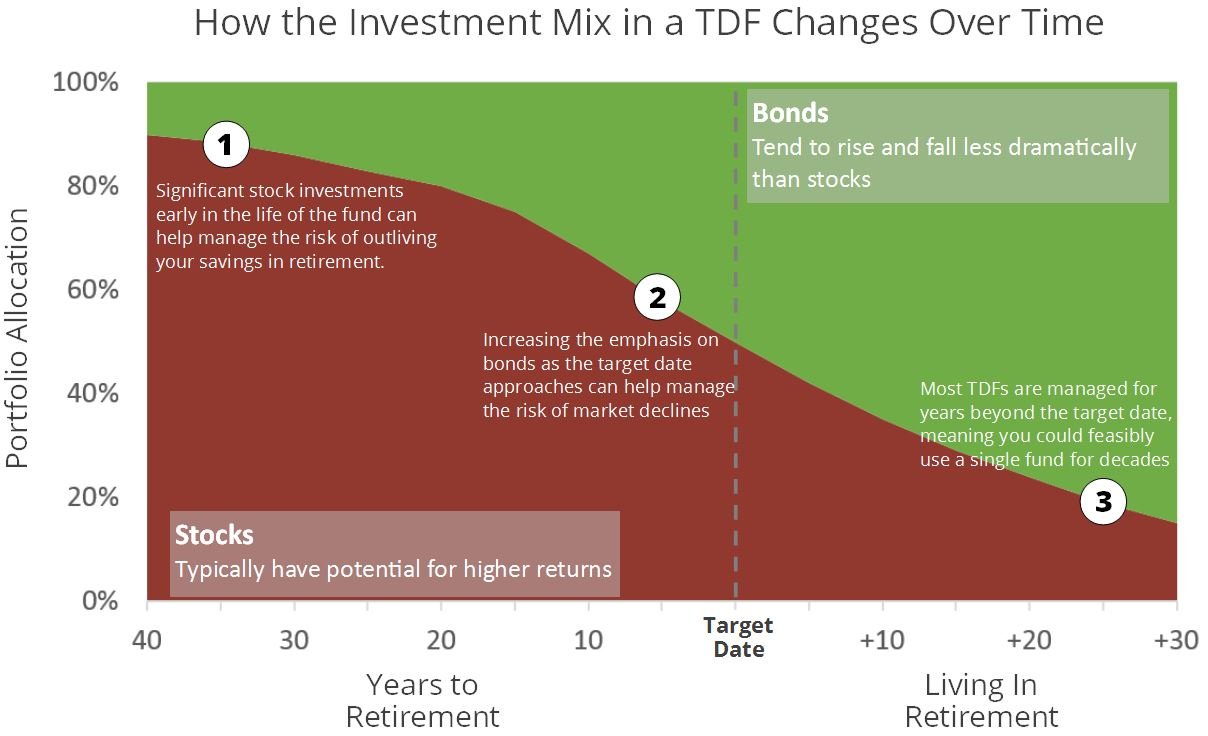

TDFs are designed for individuals with particular retirement dates in mind. In fact, the name of the fund often refers to its target date. For example, you might see funds with names like “Portfolio 2030,” “Retirement Fund 2030,” or “Target 2030″ that are intended for individuals who plan to retire in or near the year 2030. The fund’s mix of investments automatically adjusts as time moves on, becoming more conservative as you get older and closer to retirement.

In 2006, the Pension Protection Act of 2006 (PPA) authorized TDFs as a qualified default investment alternative (QDIA) in employer-sponsored defined contribution plans (such as 401(k) plans). This means that if a plan participant did not select an investment, the company could direct the participant’s assets into a TDF and not be liable for any potential losses.

Largely because of this act, the total holdings in TDFs ballooned from an estimated $110 billion in 2006 to about $600 billion in 2013. According to the latest data from the Employee Benefit Research Institute (EBRI), more than 70% of 401(k) plans offer target-date funds and 48% of 401(k) participants hold these types of funds.

Target date funds or TDFs are a convenient choice for investors who want a “set-it-and-forget-it” approach to retirement. They are also a good option for participants who don’t feel comfortable or don’t have the time to manage their own investment portfolio.

Despite the convenience, TDFs aren’t a one-size-fits-all investment option. Funds may get too conservative, too fast for some investors. Set adjustments may make it more difficult to meet financial goals if you decide to change your retirement date.

As with any investment vehicle, talk to your financial advisor or plan representative for more information. There is no guarantee a TDF will provide adequate income at or through retirement. The principal value of a TDF is not guaranteed, and the values of the funds will fluctuate up to and after the target dates. Everyone’s individual situation is unique.

At Heartland Trust, we’d be happy to help you assess whether a TDF is right for you. Reach out to us at 701.235.2002. 701.235.2002.