Roth in Retirement Accounts

“What’s the difference between pre-tax and Roth?”

This is one of the most common questions I receive when working with employees enrolling in a 401(k) plan. The decision to make either type of contribution to your retirement account (whether it is an IRA, 401(k), 403(b), etc.) is a complex decision that can have important tax implications now and in the future.

This article will cover some benefits of Roth contributions and how they compare to pre-tax contributions. It is not intended as a recommendation to contribute to Roth account. A qualified tax professional can help you make a decision that is right for your situation.

Often the question of whether to contribute to pre-tax or Roth is simplified by asking if you prefer to pay taxes now (when you earn your income) or later (when you take the money from your account). This question alludes to a big difference between pre-tax and Roth contributions, but it only scratches the surface of the complexity of the decision.

The best-known difference between Roth and pre-tax is the treatment of contributions and withdrawals for tax purposes. Pre-tax contributions reduce earned income in the year of the contribution, so the IRS does not impose a tax on money that goes into the retirement plan. Roth contributions do not reduce earned income in the year of the contribution, so your tax liability doesn’t change.

When you start taking withdrawals from your retirement account, any withdrawals that come from pre-tax contributions will be taxed as income in that year. This includes investment earnings related to the contributions. Roth contributions have already been taxed so withdrawals that come from Roth contributions are not taxed. Also, if the Roth withdrawal is a “qualified distribution,” any investment gains/earnings are tax free as well. A Roth withdrawal is considered a qualified distribution if your first Roth contribution was at least 5 years prior to the distribution and you’re at least age 59½.

All things being equal, the actuarial difference between Roth and pre-tax contributions is zero. But we know that all things do not remain equal over time.

It’s impossible to know whether your effective tax rate will be higher when you retire compared to today – and yet that is a big determining factor in which contribution type is best for you. You may be able to estimate the tax bracket you will be in during retirement, but Congress may change the tax code between now and then.

Another benefit of Roth contributions is that you may have more flexibility during distribution. Currently, Roth IRAs are not subject to Required Minimum Distribution (RMD) rules, but Roth 401(k) accounts are. Starting on January 1, 2024, Roth 401(k) accounts will no longer be subject to RMD rules. The absence of RMDs on your Roth contributions is important because depending on your financial situation in retirement, you may not need to take a distribution every year.

With pre-tax contributions, you’ll be required to take out RMDs every year after you reach a certain age regardless of your financial need. The exclusion of RMDs for Roth contributions will give you the potential to better preserve your retirement balance by only taking money out when you have a financial need to do so.

The chart below illustrates some basic comparisons of pre-tax and Roth contributions. As mentioned earlier, I recommend consulting a qualified tax professional.

| PRE-TAX Contribution | ROTH Contribution | |

| When do I pay taxes on my contribution: | At Retirement Withdrawals taken from your account are taxed ** | Today Taxes calculated through current payroll |

| When do I pay taxes on the earnings: | At Retirement Withdrawals taken from your account are taxed ** | Never If specific requirements are met * |

| Will distributions affect my taxable income during my retirement years: | Yes Withdrawals increase taxable income | No Qualified withdrawals do not increase taxable income |

Pre-tax contributions may be right for you, if:

- You are looking for a tax break today.

- You expect your income taxes to be lower when you retire.

- You want to save with a smaller reduction to your current take-home pay.

Roth contributions may be right for you, if:

- You prefer to receive a tax break during retirement rather than today.

- You expect your income taxes to be higher when you retire.

- You have many years to save before retirement.

- You like the thought of never having to pay taxes on investment earnings.*

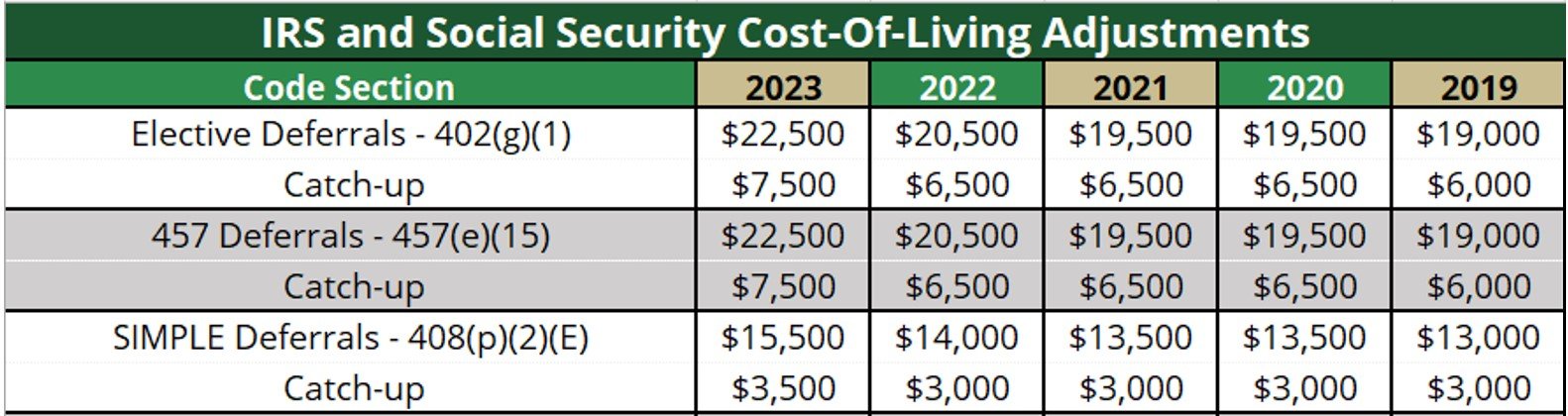

Since it is hard to predict tax laws in the future, you may be able to make both pre-tax and Roth contributions and not have all of your eggs in the same basket. For an IRA, you would need a traditional IRA for pre-tax and a Roth IRA for Roth contributions. For employer-sponsored retirement plans, you can do this within the same account. It is important to note that employer contributions to employer sponsored retirement plans goes in as pre-tax. As always, consult your accountant or tax professional to see how each option affects your personal tax situation.

*Qualified Roth distributions are tax free if your first Roth contribution was made five years prior and you are at least 59 ½ years of age

**Early withdrawals may incur additional taxes unless exceptions apply. (See Special Tax Notice for specific details)