The end of 2022 brought several noteworthy changes to retirement savings plans. The changes are intended to have positive impacts on the ability to save for retirement and will have lasting impacts on the retirement savings industry in America.

In October of 2022, the Internal Revenue Service (IRS) set the 2023 salary contribution limits for 401(k) and similar employer sponsored retirement plans. The IRS looks at these limits every year.

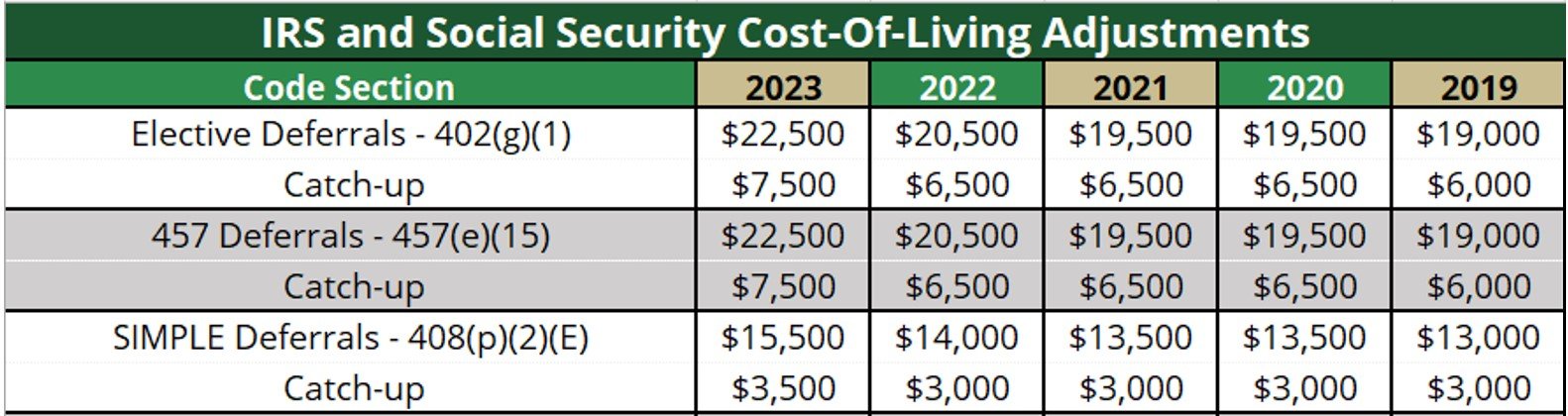

The salary contribution limit in 2023 for employer sponsored plans is $22,500, an increase of $2,000 from last year. The IRS also increased the 2023 catch-up contribution limit for employer sponsored plans, available for those who are 50 years of age or older. The catch-up limit in 2023 is $7,500, which is an increase of $1,000 from last year. As you can see in the table posted below, the increases to elective deferrals and catch-up contributions are the largest the IRS has made in the last five years.

The biggest news for the retirement savings industry happened days before the end of 2022 when the Setting Every Community Up for Retirement Enhancement (SECURE) Act 2.0 was signed into law. SECURE Act 2.0 made significant rule changes for individual retirement accounts and employer sponsored retirement plans. The act has generated a lot of excitement because its intention is to expand access to retirement plans, increase the amount being saved for retirement, and help preserve retirement income.

SECURE 2.0 has also gained attention due to its extensive scope. The act has over 90 provisions, making it triple the size of the first SECURE Act passed in 2019. Implementing SECURE 2.0 will be an industry-wide effort, requiring changes in tax laws, labor laws, payroll processes, and recordkeeping systems.

An important feature of SECURE 2.0 is that not all the provisions go into effect in 2023. The act has several provisions effective this year, but many other provisions don’t take effect until 2024 or beyond. It will take time to examine, understand, and implement all the provisions of SECURE 2.0, so this phased-in approach will allow some time for all parties to take the steps necessary to implement the act.

Here is an overview of select provisions of this act that will affect employer sponsored retirement plans:

- Starting in 2023, an individual must start taking Required Minimum Distributions (RMD) from their retirement account at the age of 73, one year later than the current RMD starting age. In 2033, ten years from now, the act moves the RMD starting age to 75.

- Starting in 2024, Roth contributions made into a 401(k) plan will be exempt from RMD requirements. Currently, an individual’s Roth IRA is exempt from RMD requirements, but Roth money in 401(k) plans is not exempt. This provision will create a uniform treatment of RMD requirements on Roth savings.

- Also starting in 2024, there is a new rule for individuals making catch-up contributions. Catch-up contributions must be made as Roth contributions for individuals that earned over $145,000. This will mean that a 401(k) plan that allows individuals to make catch-up contributions must also allow Roth contributions into the plan.

- Starting in 2025, there will be an increased catch-up contribution limit in place for individuals aged 60-63. The catch-up contribution limit for these individuals will be the greater of $10,000 or 150% of the catch-up limit for the year.

If you have any questions regarding SECURE Act 2.0 or any other retirement plan questions, give us a call or send us an email at info@heartlandtrust.com. We’re always here to help.