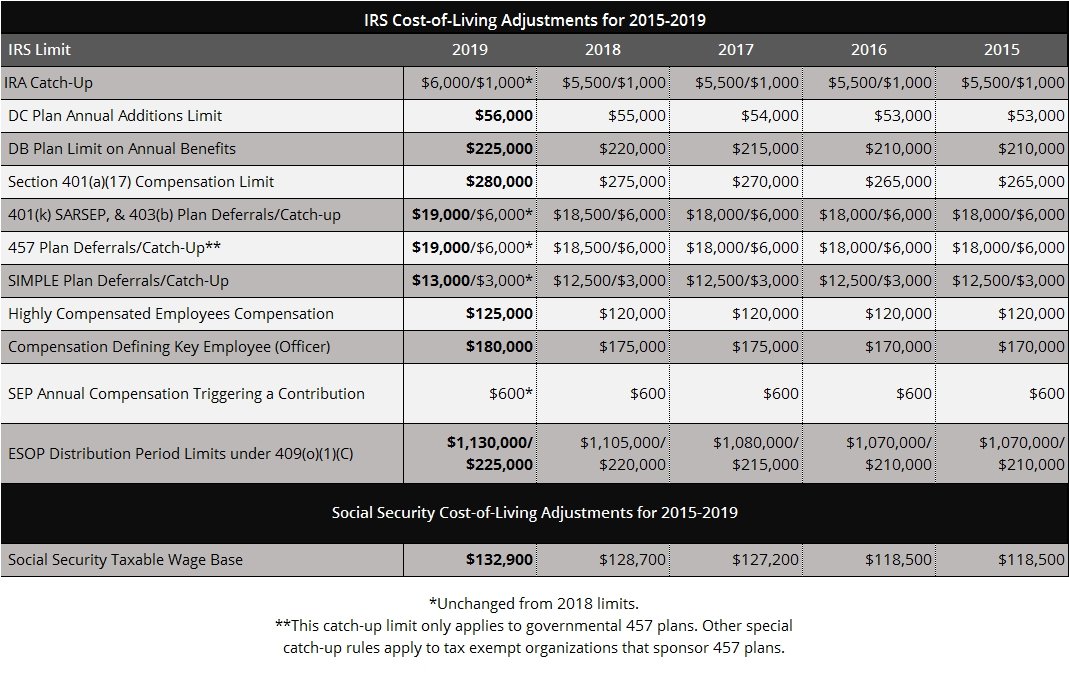

The Internal Revenue Service and the Social Security Administration have announced the cost of living adjustments (COLA) applicable to dollar limitations for retirement accounts and the Social Security wage base for 2019. Many of the limits have changed for the 2019 plan year. Changes for 2019 are in bold in the chart below.

IRA and SIMPLE plan limits are both up $500. The annual IRA limit is now $6,000 (catch-up remains the same at $1,000 for those 50 and older) and the SIMPLE limit is $13,000 (catch-up remains at $3,000).

The elective contribution annual limit for employees who participate in a 401(k), 403(b), and most 457 plans increased to $19,000. Annual catch-up contributions for employees 50 or older in those plans remain the same, at $6,000.

Employers should make sure that the individuals in charge of their payroll systems are aware of these limits. Also, employee communications and forms should be reviewed and updated as necessary to reflect these 2019 dollar limits.

The new limits were effective January 1, 2019. For a complete list of changes, visit the IRS website.