Philanthropy is a key to the success of our region. The financial generosity of donors combined with donations of time and talents directly enrich the lives of those in need. This indirectly enriches the lives of us all. If you would like to make a gift now that will benefit both you and the charitable organization of your choice, one of the options listed below might be right for you.

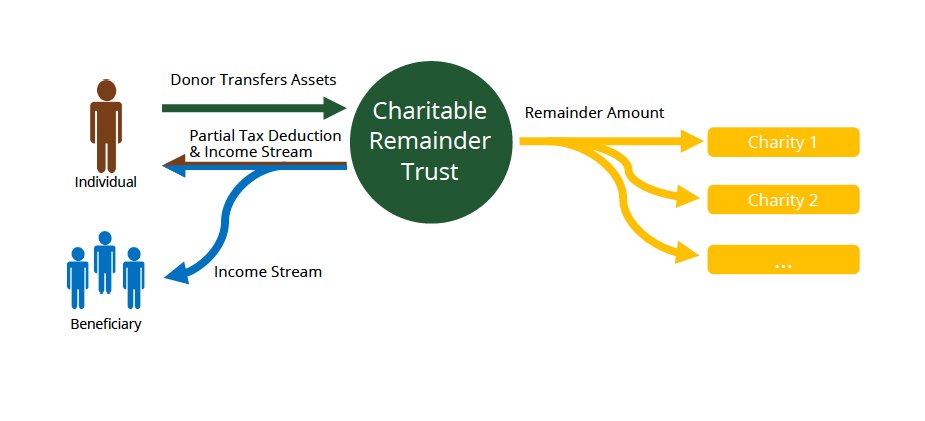

Would you like to make a substantial give to a favorite charity, but hesitate because you may need those assets to support you while you are living? If so, you may want to consider a charitable remainder trust. The trust will pay taxable income to you (and your beneficiaries, if desired) for life or a term of years. The balance of the trust is then transferred to charity. Highly appreciated assets are excellent for funding charitable trusts, as the trust does not pay capital gains tax if those assets are sold and the donor uses the appreciated fair market value to determine the amount of the charitable contribution. Establishing a charitable remainder trust creates a current federal charitable contribution itemized deduction. North Dakota residents may also qualify for the ND Tax Credit for Planned Gifts. There are a number of payout options for charitable trusts:

- A charitable remainder unitrust (CRUT) can be structured to either:

- distribute net income from the trust, or

- distribute a fixed percentage based on the fair market value of the trust assets (revalued annually)

- A charitable remainder annuity trust (CRAT)

- distributes a fixed annuity amount each year

Flow patterns of a Charitable Remainder Trust

Some individuals prefer a charitable lead trust. With this type of trust, the charitable organization will receive the trust income immediately and the assets will revert back to the owner or other individual beneficiaries at trust maturity. This can be a specified term or life (or lives) of a designated individual (or individuals). Charitable lead trusts may be structured as:

- A charitable lead unitrust (CLUT)

- distributes a fixed percentage based on the fair market value of the trust assets (revalued annually)

- A charitable lead annuity trust (CLAT)

- distributes a fixed annuity amount each year

Flow patterns of a Charitable Lead Trust

An attorney is needed to draft the charitable trust document and a trustee must be named to administer the trust. Charitable trusts are irrevocable and should be reviewed with your attorney and tax professional before signing.

Heartland Trust Company will provide personalized complimentary, confidential illustrations for charitable trusts if you would like to see how a charitable trust could benefit you and your philanthropic goals.

This is not intended to be legal or tax advice; we advise the reader to contact an attorney and/or accountant for further assistance.